foreign gift tax india

Above 15000 USD as gifts will trigger a tax event. Under current tax laws not all gifts received in India are subject to tax.

Know Types Of Direct Tax And Charges Forbes Advisor India

As a US person you are required to report any gift or bequest from a foreign person if it exceeds USD 100000 in.

. 650000 to your income and pay tax on it. For example if Michelle receives a 700000 gift from her parents in Spain she does not need to pay a tax on the gift. The task of the I-T department is now rendered easier.

Gifts of immovable properties situated outside India. An incentive is provided if the tax is paid within 15 days of making the gift. For purported gifts from foreign corporations or foreign partnerships you are required to report the receipt of such purported gifts only if the aggregate amount received from all entities exceeds 16815 for 2021 adjusted annually for inflation.

Get Your Free Credit Report. In addition gifts from specific relatives like parents spouse and siblings are also exempt from tax. The above case was considered under Section 68 which relates to cash credits in the I-T Act.

Gifts Exempt From Tax Following gifts made by any person are exempt from tax. 30000 is put to tax 30. Gifts of immovable properties situated outside India.

Gifts to Resident Indians from NRIs non-relative within INR 50000- are exempt from tax for both giver and receiver. Income Tax on Foreign Gift Income. A basic exemption of Rs.

30000 is allowed and the amount over and above this exempt limit of Rs. Therefore there is no income tax on the foreign gift. Gifts in other cases are taxable.

The Indian government introduced the tax on gifts in April 1958 and the Gift Tax Act regulates it. For instance if you receive gifts or cash of up to Rs. Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100.

The said Act was introduced to impose taxation on the exchange of gifts under requisite circumstances. Much has happened since then. Generally the answer is No.

Also gifts received outside India from foreign friends will not be taxable in India as Ayush is a Non-Resident. Cash gifts from parents who qualify as foreign persons dont subject the recipient to taxes. Tax on gifts in India falls under the purview of the Income Tax Act as there is no specific gift tax after the Gift Tax Act 1958 was repealed in 1998.

Gifts to non-relatives are exempt from tax for both giver and receiver if the amount is under Rs50000 Gifts to non-relatives above Rs50000 is taxable at the hands of the receiver Gifts for marriage or through will are exempt from taxation in India for both giver and receiver irrespective of the relationship. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

However gifts from friends or non relatives may be taxable if the aggregate value exceeds Rs 50000 per financial year. Gifts from relatives who are covered in the definition above may not be taxable in India. 1 Gifts up to Rs 50000 in a financial year are exempt from tax.

Gifts of movable properties outside. The reason is because the gift is not income. Suppose the stamp duty is Rs.

Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Gifts up to Rs 50000 per annum are exempt from tax in India. If any foreign gift tax is applicable the donor will be responsible for paying the tax on Form 709.

Home - Central Board of Direct Taxes Government of India. The Supreme Court held that the so-called foreign gifts were liable to be taxed as income. If the gifts or bequests exceed 100000 you must separately identify each gift in excess of 5000.

Fair market value FMV Rs 50000. The recipient will not have a requirement to include the gift in their gross income. Is there a Foreign Gift Tax.

50000 in a financial year you do not have to pay any gift tax on it. Gifts in other cases are taxable. When it becomes taxable the requirement of withholding tax obligation should be kept in mind especially in case of Non-Residents.

Essentially gifts here represent anything in the form of cash bank cheques demand drafts and other valuables. However the Income Tax Act 1962 includes key provisions which allow you to receive various tax-exempt gifts.

Tax Implications On Money Sent To India From The Uk Compareremit

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

Ror Has To Report Foreign Assets In The Itr Mint

Tax On Gifts In India Fy 2019 20 Limits Exemptions And Rules

What Are Tax Rules For Foreign Retirement Accounts Mint

Gift From Usa To India Taxation And Exemptions Sbnri

Did You Receive Gift Tax Implications On Gifts Examples Limits Rules

Sending Gifts To Children Relatives Abroad You May Have To Pay Tax The Financial Express

Foreign Tax Credits Of The Income Tax Toronto Tax Lawyer

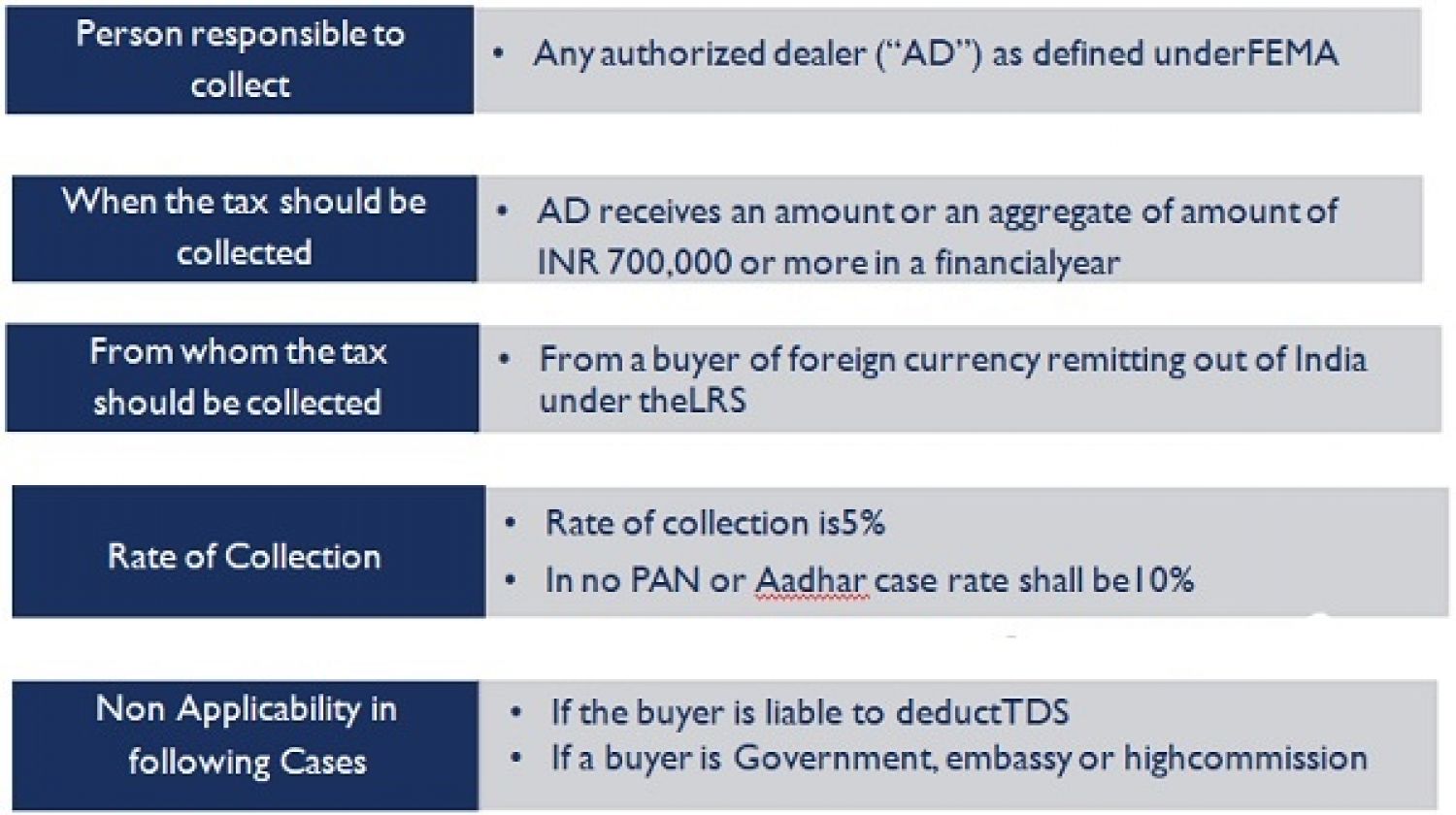

Tcs On Tax Foreign Remittance Transactions Under Lrs

Taxation Of Foreign Income In India I Taxable Non Taxable Components Youtube

Understanding Tcs On Foreign Remittance The Financial Express

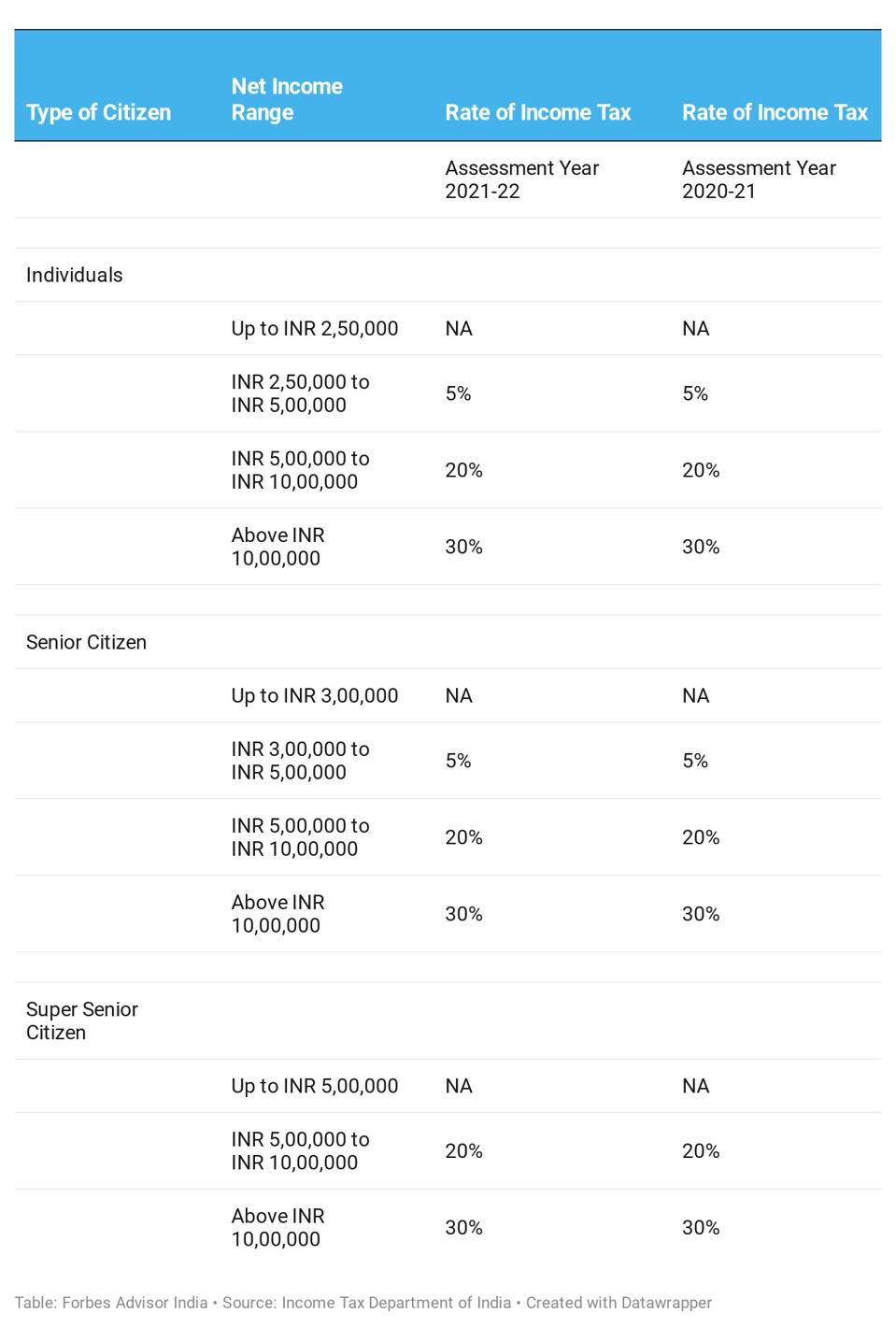

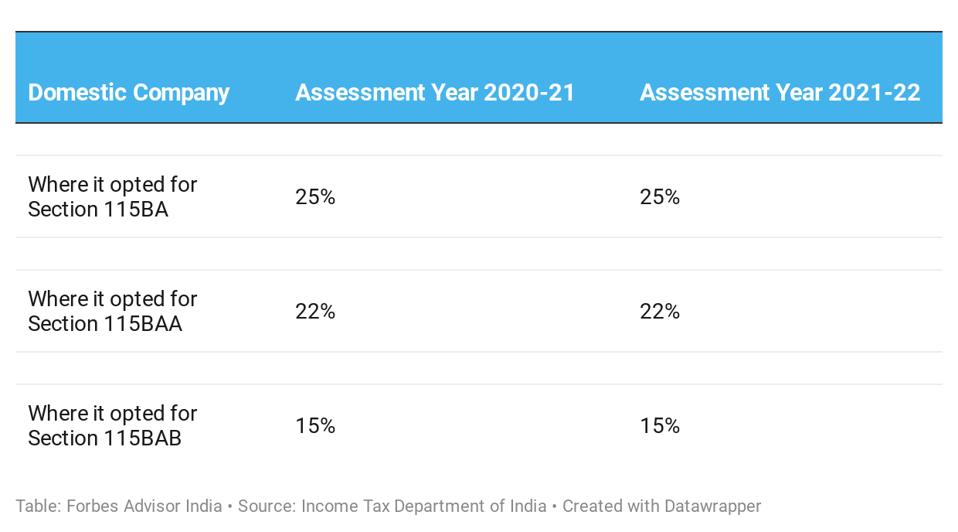

Know Types Of Direct Tax And Charges Forbes Advisor India

Tax Implications On Money Transferred From Abroad To India Extravelmoney

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable