open ended investment company taxation

The performance of the investment company will be based on but it wont be identical to the performance of the securities and other assets that the investment company owns. Free Practical Law trial To access this resource sign up for a free trial of Practical Law.

Other tax matters - TENDERCAPITAL FUNDS PLC.

. If the special regime for investment funds does not apply open-ended funds regulated under Law 352003 are subject to the general corporate income tax regime. Applicant an open-end investment company seeks an order declaring that it has ceased to be an investment company. Any part of the gain which falls within the basic rate tax band is taxed at 10 and the balance will be taxed at 20.

Income reinvestment units. A taxpayer may not elect to treat part of its cash as investment capital and part as business capital. OEICsUTs are only subject to tax within the fund on income received by the fund manager.

The direct tax treatment of OEICs is established by the Authorised Investment. The Companys ability to satisfy its obligations under an agreement with. CTM48125 - Authorised investment funds.

An open-ended umbrella investment company with seg. An open-ended investment company with variable capital Page 34-38 Shareholders and potential investors should note that the following statements on taxation are based on advice received by the Directors regarding the law and practice in force in the relevant jurisdiction at the date of this document. 05 October 2021 The taxation of unit trusts and OEICS - in a table A summary of the three types of units in a unit trust or shares in an OEIC.

City income tax under section 612 of the Tax Law and section 11-1712 of the New York City Administrative Code respectively. OEICs have been operating outside the UK for some time but only since 1997 has it been possible to operate an OEIC in the UK. OEICs are not trusts and do not therefore have a trustee.

The federal securities laws categorize investment companies into three basic types. The taxation of open-ended investment companies An outline of the main tax considerations for open-ended investment companies and investors in the UK. Unit trusts and OEICs have plenty in common in that they are both open-ended and the price of each unit unit trust or share OEIC depends on the net asset value of the funds investment portfolio.

OEICs offer a professionally managed portfolio of pooled. CG41562 - Open-ended investment companies OEICs. A money market mutual fund is a no-load open-end investment company registered under the Federal Investment Company Act of 1940 which attempts to maintain a constant net asset value per share and holds itself out to be a money market fund.

Tax within the fund. Expenses of 60886 incurred in connection with the liquidation were paid by applicants investment adviser. Open Ended Investment Companies OEICs An OEIC works in a very similar way to a unit trust except that an OEIC is legally constituted as a limited company Plc.

1 The Trust is organized as a Massachusetts business trust and is registered as an open end management investment company under the Investment Company Act of 1940 as amended 15 USC 80a-1 et seq. This practice note provides an overview of the tax issues that arise in respect of UK authorised and unauthorised unit trusts and UK open-ended investment companies. Interest and rental income are subject to corporation tax at 20.

OEICs vs Unit Trusts. If the special regime applies investment vehicles are taxed at 1 corporate income tax rate. On September 29 2017 applicant made a liquidating distribution to its shareholders based on net asset value.

An open ended investment company OEIC is a type of fund sold in the United Kingdom similar to an open ended mutual fund in the US. The Company will endeavour to satisfy any obligations imposed on it to avoid the imposition of this withholding tax. An open-ended umbrella investment company with seg.

The tax rules aim to put the investor in broadly the same position as if they had invested in the funds assets directly rather than through the fund. In document AUREUS FUND IRELAND PLC. Mutual funds legally known as open-end companies.

/london_stock_exchange-113017429-d2af52b2c72b427e8043a62cb5e01778-0b36a05ede834f7b84942c9b1b2c8bee.jpg)

Open Ended Investment Company Oeic Definition

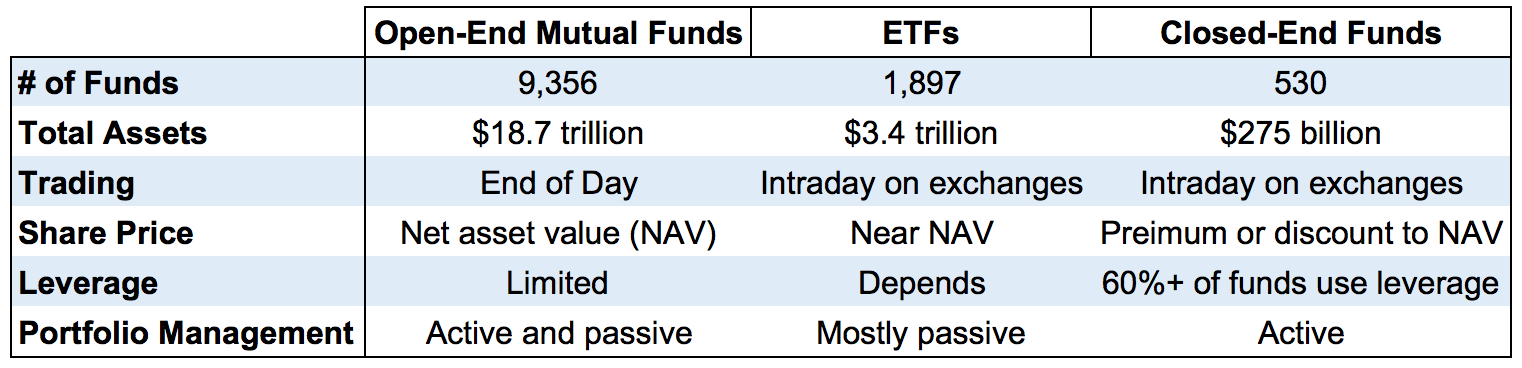

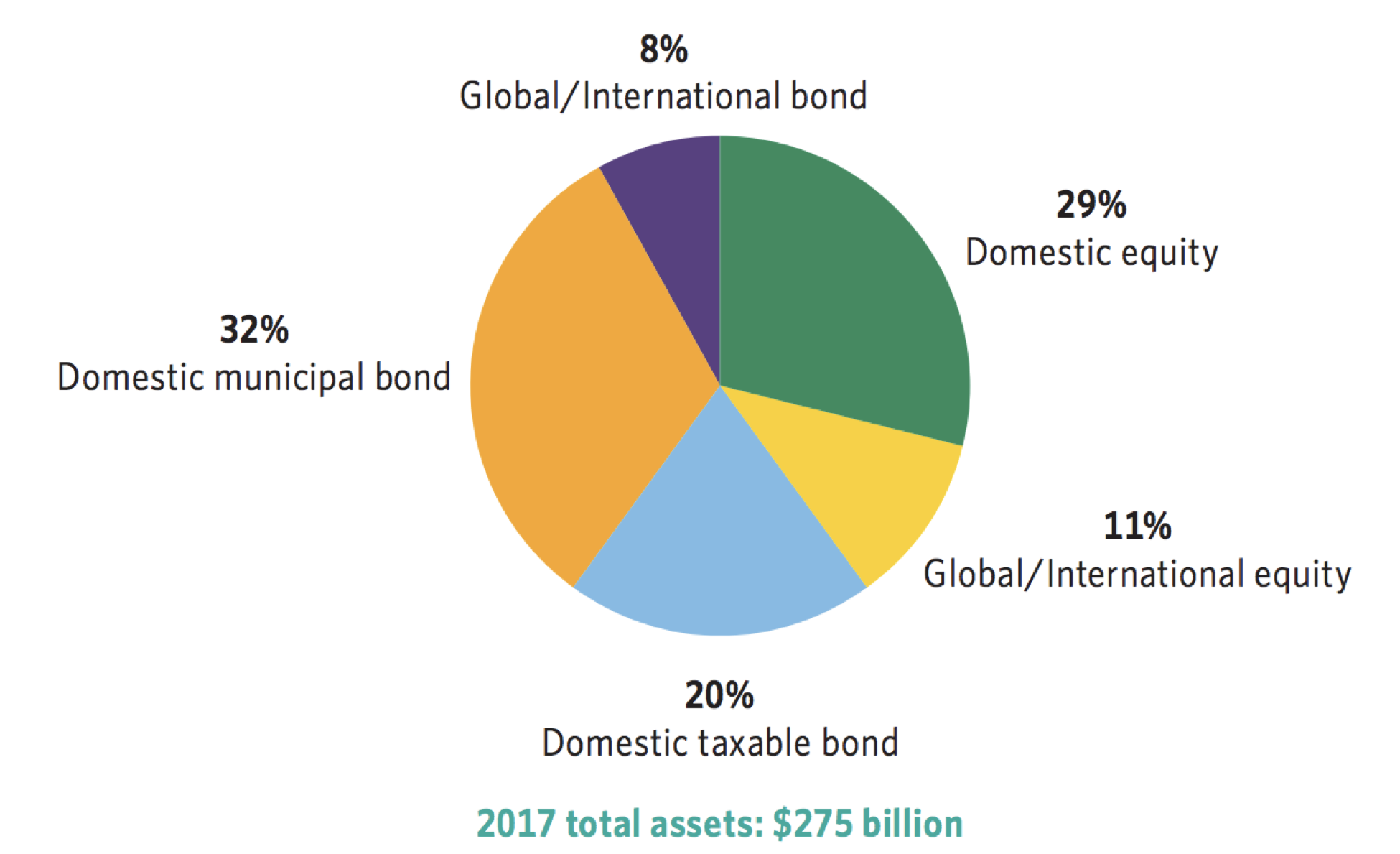

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Are Open Ended Funds Meaning Difference Advantage Disadvantage

Tax Efficient Investing In Gold

/london_stock_exchange-113017429-d2af52b2c72b427e8043a62cb5e01778-0b36a05ede834f7b84942c9b1b2c8bee.jpg)

Open Ended Investment Company Oeic Definition

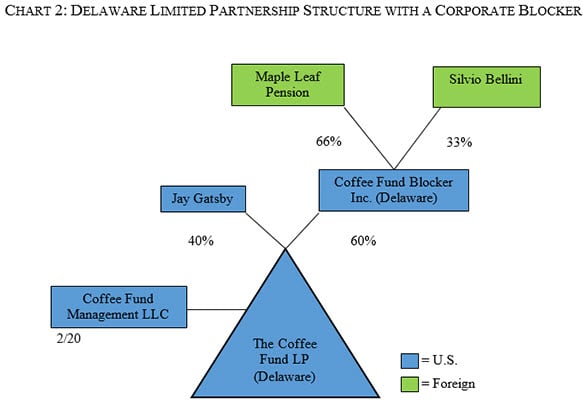

Structuring A U S Real Estate Fund A How To Guide For Emerging Managers Insights Venable Llp

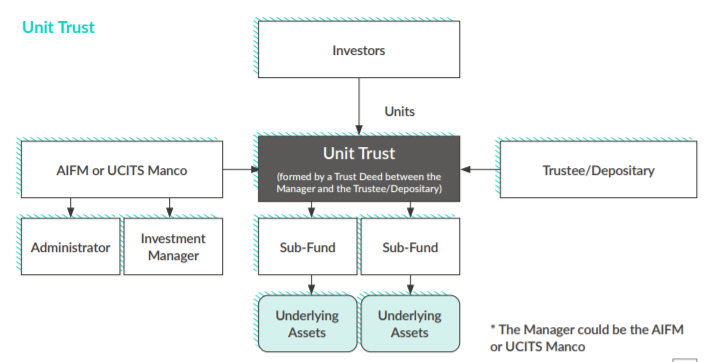

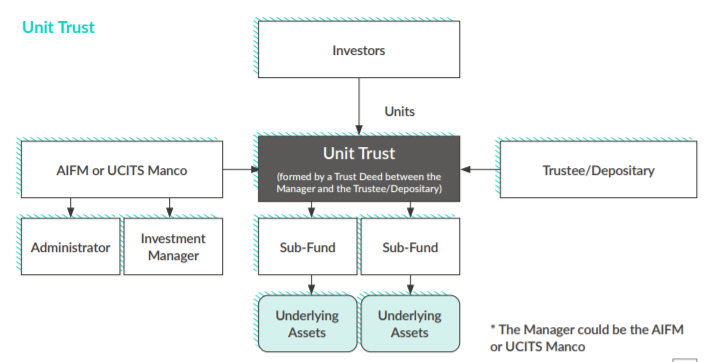

Fund Structures Unit Trusts Lexology

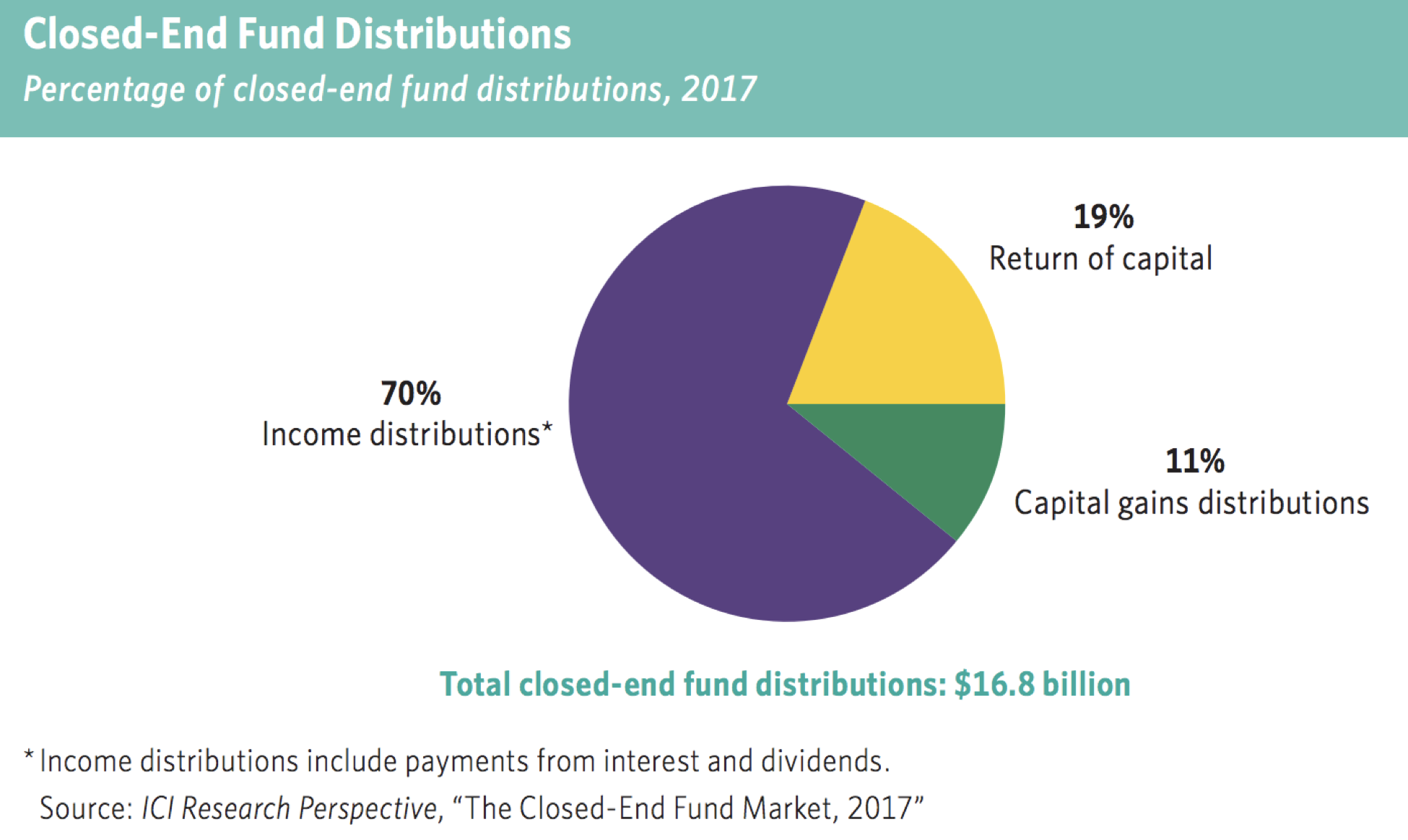

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends